- Opportuna Newsletter

- Posts

- Opportuna Newsletter #12 | Dec-25

Opportuna Newsletter #12 | Dec-25

AI Capex and Humanoids

Direct secondaries remain active, even as IPOs return. Our portfolio is developing well, with mark-ups and early signs of distribution, validating our approach.

Our previous edition focused on the use of AI in US companies, and Quantum Computing, where renewed investor interest has pushed prices and capital formation ahead of near-term commercial readiness. That tension between technological promise and economic reality is a recurring theme, and one that carries into this month’s discussion.

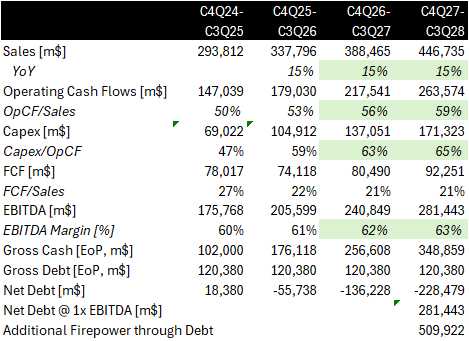

The Chart of the Month sets the frame. It maps projected data-center spending by funding source and shows how the AI build-out is being underwritten first by hyperscaler cash flows, then by balance sheets, and increasingly by credit markets. This funding mix matters. It determines both the durability of the cycle and where stresses are likely to emerge.

In Current Topics, we examine AI not through headlines but through capital allocation. Starting with the hyperscalers, we assess how much further capex can run, what constrains it, and where risks concentrate. Our conclusion is straightforward: this is not a broad AI bubble, but a spending wave with clear physical, financial, and organizational bottlenecks.

Our Long-Term Theme moves from compute to embodiment. Humanoid robotics sits at the intersection of AI capability, labor economics, and real-world constraints. Valuations have raced ahead of deployment, but the logic of the human form factor, and the size of the labor market it targets, makes this a theme worth tracking closely. We outline a framework to do so.

Secondary markets are going mainstream. In the past eight weeks, Goldman Sachs agreed to acquire Industry Ventures, Morgan Stanley set its sights on EquityZen, and Charles Schwab moved toward Forge. Motivations differ, but in both the MS and Schwab cases, the PR language leans heavily on “democratizing access to private markets”.

If access is no longer the edge, these moves reinforce our view that private markets are converging toward listed-equity dynamics. One crucial distinction remains: regulatory requirements around information dissemination. There is no Regulation Fair Disclosure. That absence makes analytical and informational edges even more critical for generating alpha.

Pitchbook dropped its 3Q US VC Valuations and Returns report. Key take-aways are:

1) Liquidity remains tight. The 12-month distribution yield sits at 12.7% of NAV—far below the 2015–2019 average of 23%.

2) IPO pops are fading. Prices for Q3’s largest listings fell after initial strength.

3) Most IPOs are still down-rounds. Over half of this year’s IPOs priced below their last private valuation.

4) AI dominates M&A. A handful of high-value AI acquisitions accounted for most of Q3 dealmaking. AI continues to escape the valuation compression hitting other sectors.

5) Secondaries remain a small - but important - release valve. PitchBook estimates direct secondary volume reached $61.1 billion as of Q2 2025, versus $246 billion across traditional liquidity routes (buyout, IPO, acquisition). Secondaries help, but they are still modest relative to the market’s overall liquidity needs.

📈 Chart of the Month: 2025-2030 Datacenter Spending by Funding Source

🌐 Current Topics: Paradise, Purgatory, and Hell in AI Spending

Readers keep asking whether we are in an “AI Bubble.” It is the wrong question. AI spending is not binary (bubble / no bubble). It is stratified. At the center sit cash-flow-rich hyperscalers. As you move outward - toward leverage, credit, and speculative balance sheets - risk rises. Hell is not AI itself, but how it is funded.

Hyperscalers are not close to their spending limits. Management teams at Amazon, Meta, Microsoft, and Google have been explicit: they would rather overspend than underspend. Capex growth ultimately depends on revenue expansion, operating cash margins, and the share of cash flow allocated to infrastructure. On these measures, Microsoft alone could plausibly take annual capex to $171bn within three years - roughly 2.5x its trailing pace.

Source: Opportuna, based on Koyfin

The same pattern holds for Google, Meta, and Amazon. Our framework suggests room for 2.2x, 2.3x, and 1.8x increases respectively. Underlying AI-related capex would grow faster still as other categories are deprioritized. And these numbers rise meaningfully if debt enters the picture: levering each company to just 1x net debt-to-EBITDA would unlock roughly $1.5tr of additional firepower, on top of $1.7tr they can self-fund over three years. At that point, 40–50% annual capex growth becomes achievable.

There are risks to this trajectory. Rising capex suppresses free cash flow growth, the ultimate anchor of valuation. These businesses are becoming more asset-heavy, and ROIC will compress during this investment phase. Yet AI-enabled efficiency gains could lift already-high profitability, expanding the very cash flows that fund the build-out and giving hyperscalers more room to spend or to lever.

Supply constraints are the counterweight. Nvidia and GPUs sit at the receiving end of hyperscaler capex, but the real bottleneck remains TSMC, whose leading-edge fabs are mostly in Taiwan and expanding cautiously. Physical capacity limits are binding, and the company continues to see AI demand exceeding expectations. The company plans for mid-40% CAGR in AI demand even without China, and C.C. Wei told analysts in the most recent earnings’ call: “the AI demand actually continue to be very strong and stronger than we thought three months ago.” Data centers face their own constraints: record-low vacancy rates, rapid credit-financed build-outs and long lead times for HVAC systems, transformers, turbines and grid upgrades, all of which raise the risk of project delays.

Source: When AI Hype Meets AI Reality: A Reckoning in 6 Charts, WSJ, November 14th 2025

Further away from hyperscaler cash flows, stress is already visible. CoreWeave and Nebius weakened on earnings and debt concerns, while Oracle’s shares sold off sharply following heavier-than-expected AI capex guidance. CDS spreads on both CoreWeave and Oracle widened, signaling rising credit risk and growing investor skepticism toward debt-financed AI expansion.

Private markets are the frothier zone. Reflexivity remains high, valuations increasingly reflect capital availability, and funding has concentrated in a handful of investors and assets. Talk of IPOs for OpenAI and Anthropic suggests that private-market liquidity is tightening and that sentiment is beginning to shift.

This is not a broad AI bubble. Risks are concentrated instead in private markets, AI-linked credit, and data-center execution, while GPU supply remains structurally constrained. The hyperscaler spending wave, however, is far from finished.

🧭LT: Humanoids - Hype Today, Labor Tomorrow

The recent $1bn raise of Figure at a $38bn valuation, an 17x increase in 18 months, highlights the excitement “Humanoids” generate. The amounts raised and the valuation reached contrast with the lack, so far, of large commercial deployment. In this section, we unpack the reasons behind the excitement and suggest a framework to track adoption acceleration.

Many investors question the need for humanoid robots when specialized forms are possible. However, the strongest argument is that the current environment is already "brownfielded" for human anatomy since our world was built by and for humans. This human form factor allows for the seamless integration of robots into existing infrastructure and tasks. Furthermore, the immense variety of tools and machines already designed for human hands can be readily utilized by these robots.

Viewed through the lens of human labor replacement, the Total Addressable Market (TAM) for Humanoids is immense. In the US alone, based on the current employee occupation structure, 60-80m headcounts could be replaced or augmented by humanoids, representing 35-45% of the labor force. Putting the societal backlash aside – not a small assumption -, at an average wage of $53k, we are talking about a budget of $3.7Tr to go after.

A Humanoid fundamentally requires three key elements: 1) a decision system, 2) a body, 3) a fuel. Each of these has experienced fast improvements in the last 24 months. For the decision system, Large Language Models (LLMs) and Generative AI (GenAI) accelerates how physical machines learn through natural language, imitation, and simulation. This innovation, often driven by multi-modal models (MMMs), allows robots to observe and imitate behaviors in both real and virtual worlds, significantly shortening the R&D cycle.

Although we have seen improvements in the body and the fuel, these depend on atoms rather than digits, which could slow progress of the overall systems. Actuators, the key mechanical part, represent 50-60% of Humanoids Bill of Material (BOM); they are a critical element to innovate on. Battery influence uptime, which in turn impacts the ROI of a Humanoid, and the TAM.

China: Speed and Scale. China is the fastest-moving ecosystem, driven by strong state policy (e.g., MIIT's 2024 roadmap for a full-stack ecosystem by 2025) and an agile supplier base. More than 35 new humanoid models launched in 2024 alone. Leading players like UBTech, Fourier Intelligence, and Unitree leverage this model to prioritize rapid iteration and aggressive cost reduction, aiming to shape global standards through sheer scale, despite current limitations in dexterity and safety.

North America: Vertical Integration. North American firms focus on vertical integration and proprietary technology stacks, believing tight ownership of the full system (actuators, control systems, AI) yields superior performance and defensible IP. Tesla (Optimus), Figure AI (piloting at BMW), and Apptronik are developing custom hardware and AI stacks for high-value manufacturing use cases. This approach is slower and more capital-intensive but prioritizes reliable, certifiable robots for complex environments.

Europe: Safety and Trust. Europe is establishing a "trusted humanoid corridor," focusing on safety, compliance, and human-centric design, supported by a strong base of component suppliers. Companies like Neura Robotics (cognitive humanoids), PAL Robotics (proven navigation), and 1X (embodied AI, backed by OpenAI) leverage forthcoming regulatory clarity (e.g., EU AI Act) and emphasize building trust through advanced features like tactile sensing and expressive interaction.

The question is not whether humanoids will matter, but when systems become reliable enough to justify capital at scale. Adoption will lag innovation, then compress quickly once economics and regulation turn decisively favorable.

📌 Conclusion

The right question is not whether AI or humanoids are overhyped. It is where capital is flowing, on what balance sheets, and under which constraints. Cash-flow-funded investment remains robust. Credit-funded expansion is where fragility appears. That distinction will matter more than narratives in the year ahead.

At Opportuna, this is the lens we apply across public and private markets: follow the cash flows, respect physical limits, and be selective where capital structure - not technology -sets the risk. We thank you for the exchanges and trust this year and wish you a restful festive season. We look forward to continuing the conversation in 2026.

If you’re in Zurich or beyond and want to exchange perspectives, reach out.

Warmest Regards,

The Opportuna Team