- Opportuna Newsletter

- Posts

- The Opportuna Assembler #1

The Opportuna Assembler #1

AI Agents Decisions / Green Shoots in Software

Welcome to The Opportuna Assembler, a collaboration between 3dot Insights and Opportuna, where we discuss the timely issues facing the software industry.

In fewer than 1000 words, we help industry watchers “assemble” the pieces of the software industry puzzle.

In this edition we cover:

The AI Agent Decision Making Problem – we see reliable agentic frameworks emerging to replace automation and orchestration suites across all industries.

The Green Shoots in Software IPOs – bringing a financial lens to the software industry and the liquidity traffic jam.

Solving The AI Agent Decision Making Problem

AI is very rapidly evolving beyond large language models (LLMs) towards more specialized, compact agents. These AI agents interact with their surroundings to complete tasks, operating independently or with minimal supervision. While early implementations were limited to controlled, simulated environments, recent progress in agentic frameworks has significantly improved these agents’ adaptability and efficiency.

In an agentic framework, agents are able to direct their own actions, take responsibility for those actions, and navigate challenges.

Unlike resource-intensive LLMs, these smaller agents can function with minimal infrastructure. Agentic design further supports decentralized operations, prioritizes user privacy, continuous adaptability, and customization.

However, entrusting AI agents with critical decision-making authority still faces several obstacles:

· Agent adaptability

· Trust in agent reliability and accuracy

· Inadequate evaluation techniques

Many enterprises encounter hurdles when attempting to seamlessly incorporate AI agents, especially in environments where multiple agents interact. Concerns about security, privacy, reliability and accuracy continue to be significant. As a result, most of today’s implementations require human supervision, which impedes the widespread deployment of fully self-governing systems. These combined factors must be overcome before we see broad acceptance and implementation of truly autonomous AI agents across various industries and applications – the expectation is that it is only a matter of time before we get there.

Over the next few years, we will very likely see reliable agentic frameworks solidify, replacing or augmenting automation and orchestration suites across all industries. As reliability and accuracy issues are resolved, we will also see an increasing degree of autonomy and more inter-agent interactions as multi-agent systems (MAS) become the norm. One can envision an autonomous MAS automating workflows, with a cadre of auxiliary agents documenting, auditing, testing, optimizing, and security hardening MAS generated content.

Looking further ahead, the coming decade will usher in agent marketplaces where specialized, prefab “teams” of agents will be “hired” on an hourly basis to tackle common corporate and business workflows, such as compliance, supply change management, logistics, resource scheduling, customer care, and order fulfilment. The better MAS teams will garner higher rates, while low-cost alternatives will offer entry-level candidates – not unlike today’s job boards.

Green Shoots for the Software IPO Traffic Jam

Software was once exciting, but since Q2 2021, sales have slowed. The launch of ChatGPT in November 2022 amplified concerns about potential disruption to software vendors. However, signs of recovery in public markets may provide a boost to private software companies. Will 2025 reboot software in public markets occur?

We track software performance relative to the broader technology sector using ETFs:

· The iShares Expanded Tech-Software ETF (IGV) covers North American software companies, with Oracle, Salesforce, and Microsoft as its top holdings.

· The iShares Semiconductor ETF (SOXX) focuses on US semiconductor companies, with Broadcom, Qualcomm, and Nvidia as its largest holdings.

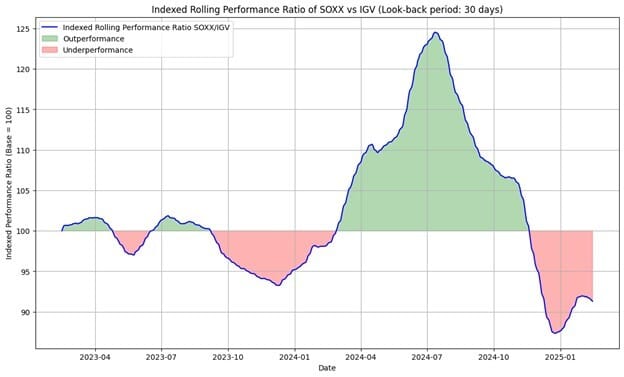

Comparing the 30-day rolling performance of SOXX versus IGV reveals that for most of 2023, they moved closely together. This changed in early 2024; since then software and semiconductor performance have mirrored each other. In the first half of 2024, Semiconductors outperformed Software; since July 2024, software has regained its appeal, signaling potential momentum in the sector.

Source: Author using FMP

We also wonder whether expectations have reached the bottom. The Meritech Software Pulse of January 23rd , 2025, which tracks public SaaS companies, noted that no company has NTM Rev YoY > 30%. This seems unusual, although we haven't conducted a complete historical analysis. Data from 225 software companies which reported earnings in the last two months implies stabilizing growth, reversing the deceleration since Q2 2021. While this could reflect overoptimism from management and analysts, feedback from IT decision-makers supports the improving outlook.

In short, we expect stable growth, achievable expectations, and an improving outlook for software companies, which will facilitate IPO and private equity exits while providing much needed distributions to private market investors.

Thank you for reading the first edition of The Opportuna Assembler. We’ve enjoyed exploring the challenges of autonomous AI agents and the emerging opportunities in software IPOs. Stay tuned for more insights in future editions as we continue to unpack the evolving tech landscape. Have a great week all.

If you are looking for some deeper dives into the convergence of private and public tech investing, take a look at our latest monthly newsletter, Opportuna Newsletter #6: Databrick and Stablecoins.

Was this email forwarded to you? Sign up here.