- Opportuna Newsletter

- Posts

- The Opportuna Assembler #2

The Opportuna Assembler #2

Beyond LLMs / Identity in Focus

Welcome back to The Opportuna Assembler, where we break down the biggest issues facing the software industry.

In collaboration with 3dot Insights we help industry watchers “assemble” the pieces of the software industry puzzle – in under 1000 words.

In this edition we cover:

What Lies Beyond Today’s Language Models - how the industry is solving uncertainty, safety vulnerabilities, and transparency issues

Cybersecurity’s Earnings Pulse – identity, access, and privilege management outperform!

Whilst we are not covering here the implications of the massive $32bn Wiz acquisition by Google for private cybersecurity companies, we are happy to send you our views. Register here. We will share the best ideas with those who answered.

Evolving AI: What Lies Beyond Today’s Language Models

In an industry swept up in the latest wave of hype, it is critical to provide a sobering counterpoint on contemporary Language Models (LMs). Even the most advanced LMs struggle with uncertainty, ethical constraints, difficulties with task adaptation, safety vulnerabilities, and a fundamental lack of transparency.

To address these, many innovators are seeking to integrate a range of emerging “post-LM” approaches – new techniques designed to move beyond the limitations of today’s models. These include neurosymbolic AI, various reinforcement learning techniques, the Synthesis of Tailored ARchitectures (STAR), Mixture of Universals (MoU), Transformer-Mamba Mixture of Experts, liquid neural model types, state space models (SSMs), and learnable activation models such as Kolmogorov-Arnold networks (KANs). This is what we call "Holistic AI”.

To transition to Holistic AI, enterprises will need new data representations, adaptive processes, and stakeholder buy-in. Custom datasets, multimodal integration, context awareness, attention mechanisms, neurosymbolic integration, adaptive learning, metacognition, self-regulation, grounding, guidance, and alignment with human values will all be crucial. Yet even with robust Holistic AI deployment, challenges like trust, fairness, benchmarking, unlearning, and the inherent randomness of the real world will not disappear overnight.

That said, post-LM techniques like Holistic AI are the next step for emerging tech.

Cybersecurity’s Earnings Pulse

All major listed cybersecurity companies have reported results since our last Assembler. What did management commentary, guidance, and stock reactions reveal?

To find out, we ran a sentiment analysis on earnings transcripts. The results?

Most upbeat: Okta - in a shift from recent quarters the CEO Todd McKinnon highlighted accelerating growth metrics and strong execution in security advancements and product innovation.

Most downbeat: Rapid7 - with repeated reference to risks, operational challenges, and the need for "foundation work" to regain momentum, the language pointed to a cautious and defensive stance.

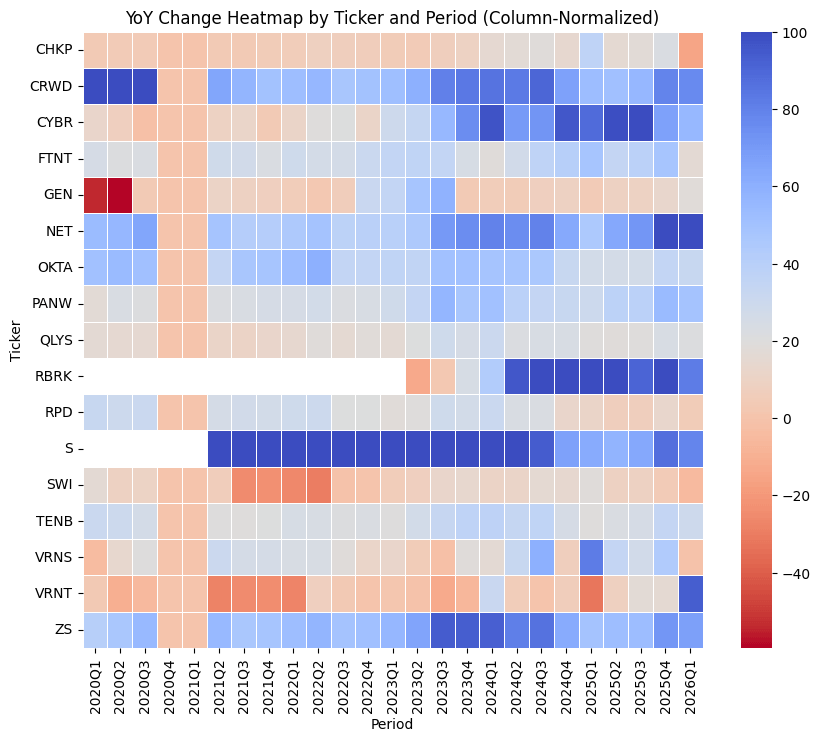

Sales trends reinforce this narrative. Chart 1 compares year-over-year growth rates across cybersecurity firms. In Q1’25, Tenable, Rapid7, and Qualys posted some of the slowest growth rates, while CyberArk and Rubrik led the pack.

Chart 1: Comparative YoY Change in Sales for Cybersecurity Companies, Q1’20-Q1’26

Source: Author using FMP

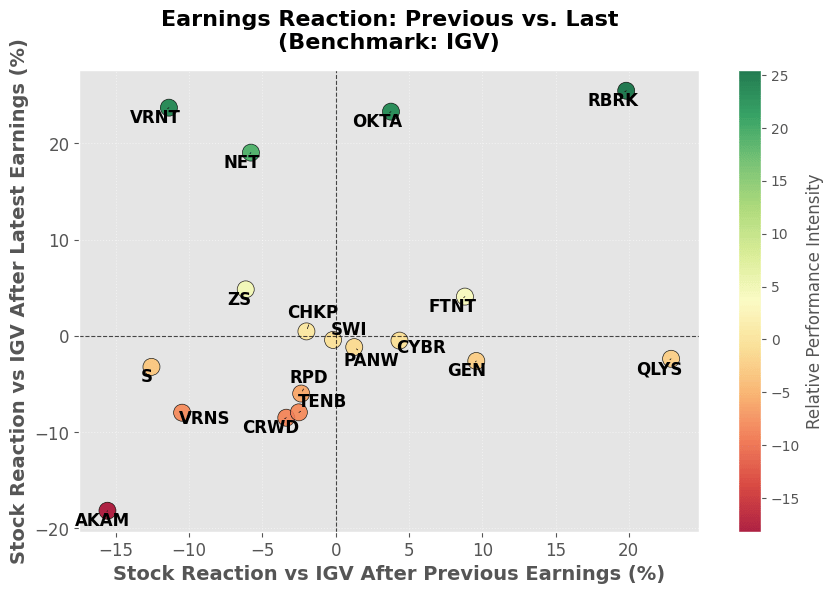

The focus on identity, access, and privilege management caught investors off guard. Chart 2 tracks post-earnings stock performance relative to the iShares Expanded Tech-Software ETF (IGV), which benchmarks North American software stocks, led by Oracle, Salesforce, and Microsoft. Okta and Rubrik saw strong reactions, while vulnerability management vendors (TENB, RPD, QLYS) underperformed, suggesting weak growth wasn’t fully priced in.

Chart 2: Positive Reactions in Identity

Source: Author using FMP Data

Some stocks signaled potential inflection points:

Verint and Cloudflare appear to have turned a corner.

Akamai’s troubles persist.

Rubrik’s strong performance—both in fundamentals and stock price—is noteworthy for private markets.

Liquidity depends on confidence, and for IPOs to gain traction, investors must trust the quality of companies coming to market.

Thank you for reading the second edition of The Opportuna Assembler.

We’ve enjoyed sharing a glimpse of what lies beyond today’s LMs, the new techniques emerging … and the challenges they’ll face.

If you’re looking for deeper insights into the convergence of private and public tech investing, look at our latest monthly newsletter, Opportuna Newsletter #7: AI and the Rise of Reasoning Models.

Was this email forwarded to you? Sign up here.